Business Insurance in and around Bedford

Get your Bedford business covered, right here!

Helping insure small businesses since 1935

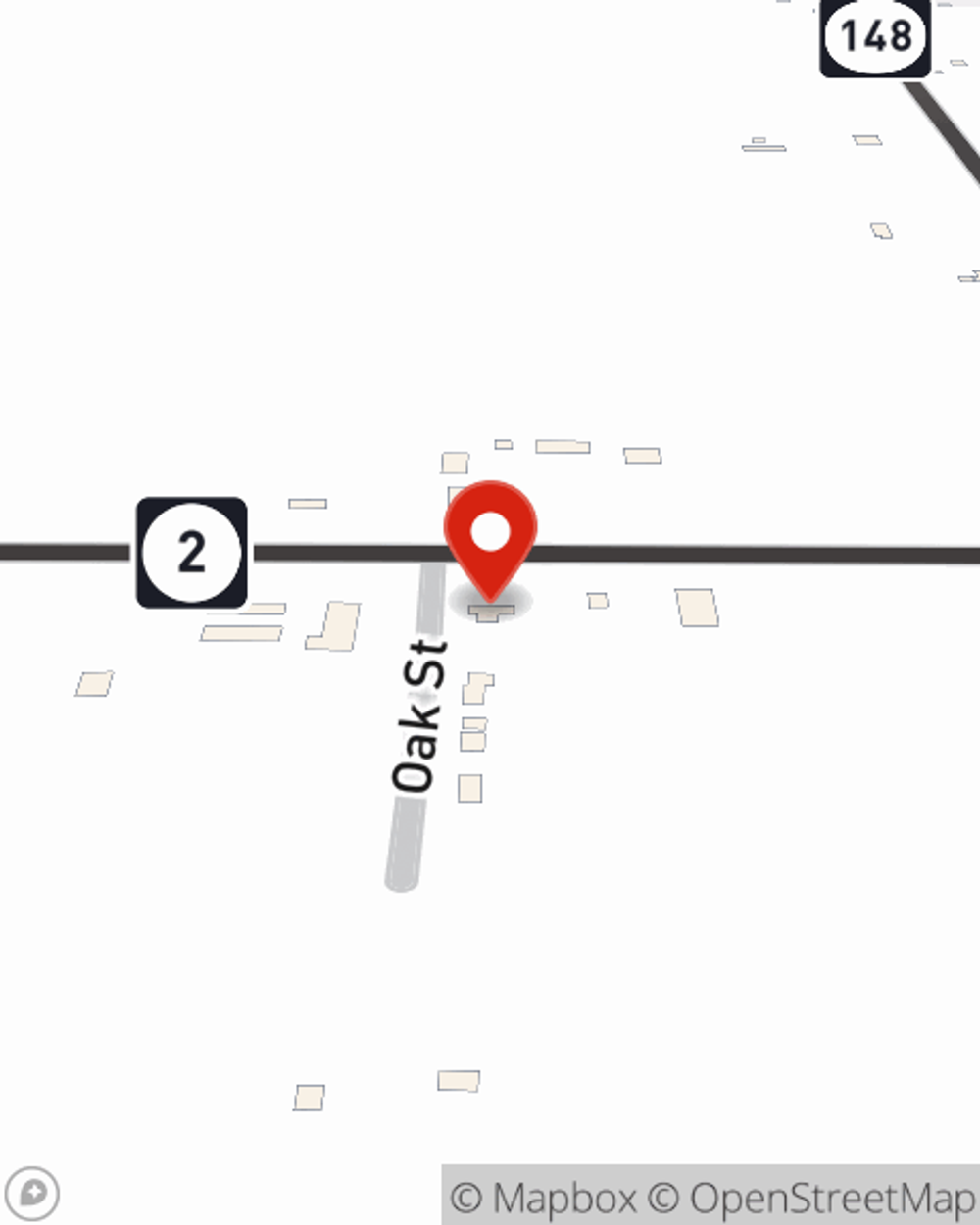

- Bedford, Iowa

- New Market, Iowa

- Hopkins, Missouri

- Ozarks, Missouri

- Kansas City, MO

- Corning, Iowa

- Lenox, Iowa

- Blockton, Iowa

- Villisca, Iowa

- Des Moines, Iowa

- Lamoni, Iowa

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, business continuity plans and extra liability coverage, you can feel secure knowing that your small business is properly protected.

Get your Bedford business covered, right here!

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

Your company is unique. It's where you make your living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or a shop. Your business is part of who you are. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like a hair stylist. State Farm agent Susan Martin is ready to help review coverages that fit your business needs. Whether you are an electrician, a fence contractor or an HVAC contractor, or your business is a clothing store, an appliance store or a funeral home. Whatever your do, your State Farm agent can help because our agents are business owners too! Susan Martin understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Agent Susan Martin is here to consider your business insurance options with you. Call or email Susan Martin today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what that is and how you can be ready.

Susan Martin

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what that is and how you can be ready.